Expense Hacks for Living in Luxury Apartments in Kochi

7 Min Read

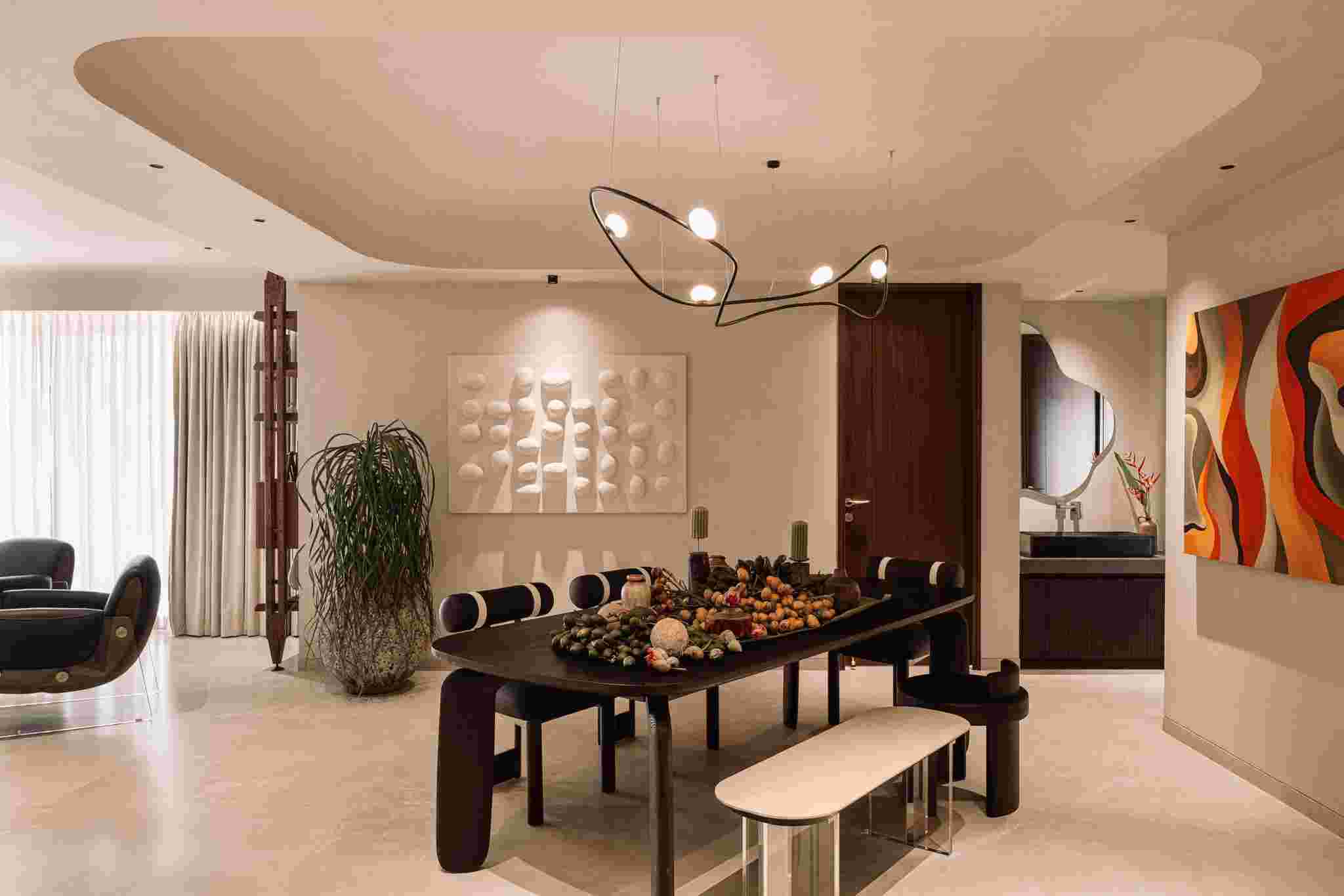

Living in luxury apartments in Kochi offers a wonderful experience, thanks to the city's lively culture, beautiful landscapes, and modern amenities. However, managing household expenses can be quite challenging, especially for individuals who are new to apartment living. In this blog, we will explore effective tips and strategies for managing household expenses in Kochi apartments.

Track Your Expenses

To effectively manage your household expenses, it is important to first identify the areas where your money is being spent. Start by keeping a record of your expenses for a month, which will provide you with a clear overview of your financial habits. Create a detailed list of all your routine expenses, such as EMI, utilities, groceries, transportation, and entertainment. This will help you to identify areas where you may reduce spending and make appropriate changes. Moreover, understanding the various types of expenses, such as fixed expenses, variable expenses, and discretionary expenses, is essential.

Creating a Budget

After gaining a clear picture of your expenses, the next logical step is to create a budget. A budget functions as a guideline for the distribution of your funds across various expenses. Start by setting financial goals, which may include saving for a business or paying off existing debts. Then, distribute your income across various expenses, prioritizing your essential needs above your desires. It is also advisable to follow the 50/30/20 rule, which recommends that 50% of your income should be dedicated to necessities, 30% to discretionary expenses, and 20% to savings and debt repayment.

Managing Utility Bills

Utility bills can be a significant expense for residents of apartments in Kochi. To manage these expenses effectively, it is important to understand how your usage contributes to your bills. Consider investing in energy-efficient appliances and make a habit of switching off lights, fans, and electronic devices when they are not in use. You can also explore options like solar power and rainwater harvesting to reduce your dependence on traditional power sources. Negotiating with utility providers may also lead to more favorable rates and discounts.

Saving on Groceries

Grocery expenses are also a major financial burden for families residing in Kochi. To reduce these costs, it is advisable to begin with meal planning and to create a structured shopping list. Purchasing items in bulk and exploring local markets or online shopping options can also provide financial relief. You can also explore options like cooking at home instead of eating out and using coupons or discount codes to save money. Utilizing cashback applications and rewards programs can offer opportunities to earn back some of the money spent on groceries.

Avoiding Lifestyle Creep

Lifestyle Creep refers to the tendency of individuals to upgrade their lifestyle in response to increased income. To avoid falling into this trap, it is important to define clear financial targets and to prioritize essential needs over personal desires. One effective method is to create a "reverse budget," where you allocate your income towards your financial goals first and then use the remaining amount for discretionary spending. Additionally, the "envelope system" can be utilized, allowing individuals to categorize their expenses and manage the use of cash for discretionary purchases.

Conclusion

Managing household expenses with efficiency is essential for achieving a stress-free and satisfying lifestyle in Kochi. By applying these tips and strategies, you can gain control over your finances and work towards achieving your financial goals. Kent Constructions, known for offering some of the best flats in Kochi, provides well-designed apartments equipped with modern amenities, presenting an excellent opportunity for affordable living. Maintaining discipline, patience, and a well-informed perspective will set you on the path to successfully managing household expenses.